2018 Saver’s Tax Credit

- March 18, 2019

- Posted by: Jeff Atwell

- Category: Finance & accounting, Resources

No Comments

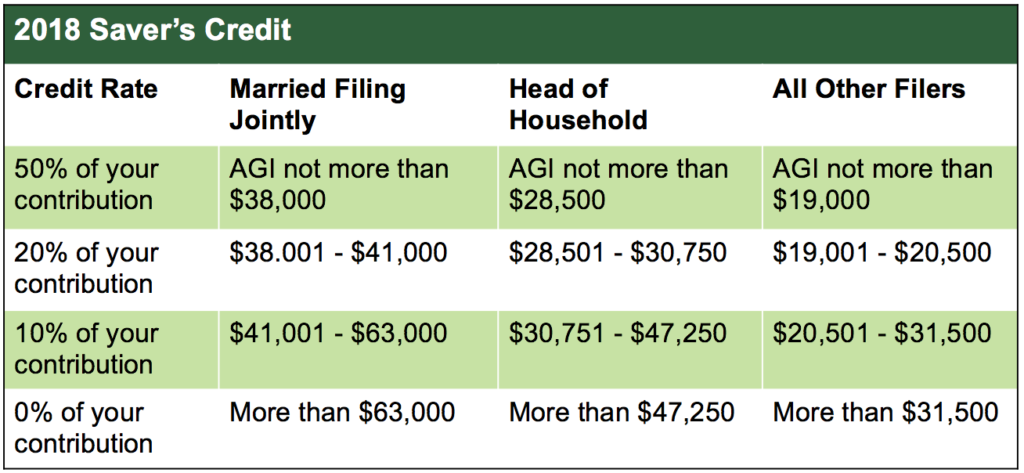

Individuals who made salary deferral contributions to a 401(k) or 403(b) plan in 2018 may be able to take advantage of an additional tax credit when they file their 2018 income tax return.

This is in addition to the income tax saved throughout the year as pre-tax deferrals were contributed to the retirement plan. This tax credit is specifically intended to give lower income earners the ability to save for retirement and be able to potentially receive any employer matching contributions.

Here is a summary of how the credit works: