DC Plan Sponsors React to Coronavirus with Moderation

- April 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

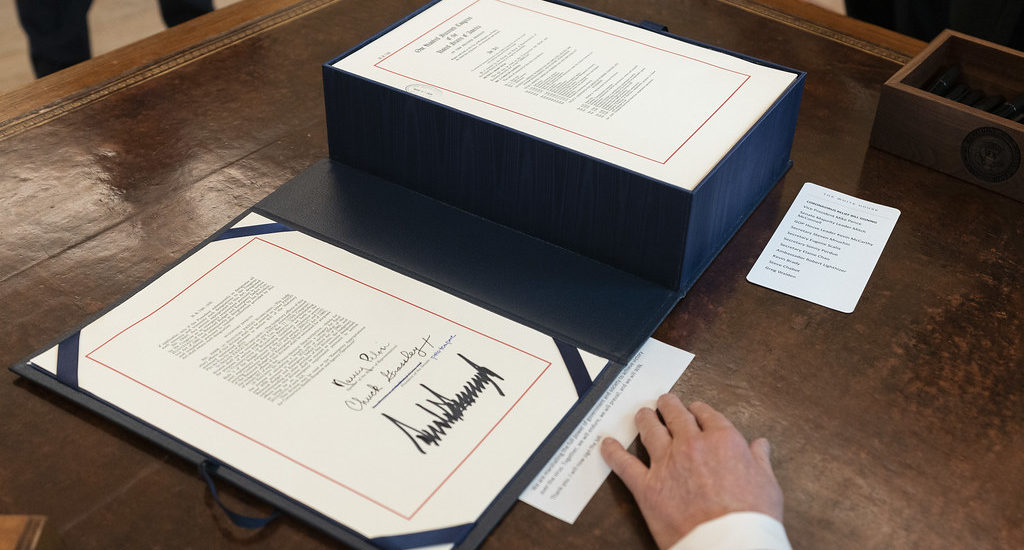

Retirement plan professionals and plan sponsors are continuing to evaluate the provisions of the CARES Act. As this article from Plan Sponsor article indicates, the majority of plans have now elected to adopt some or all of the CARES Act provisions. This creates an opportunity for retirement plan professionals to create added value for plan sponsors and participants who are, or might be considering utilizing the CARES Act options.

Before liquidating any investments, a participant needs to consider the fact that the market has suffered a large decrease. This means that if investments are sold now, the loss is “locked in,” and those funds will not participate in the value increase when the market recovers. The impact on the participant’s ultimate retirement savings is likely to be significant. If a participant has other assets that can be accessed for the financial challenges being faced, it may be a good idea to use those instead, leaving the retirement funds to recover and be there for when they are needed down the road.

If a participant, a qualified individual, elects to take a distribution, they can spread their tax liability over a 3-year period. The participant will need assistance on how to manage their tax liability based on their income needs and income tax rate in the years ahead. For example, a participant took a $36,000 distribution and paid taxes of $12,000 in 2020 and $12,000 in 2021. In 2022, the participant deposits $36,000 back into a retirement plan or IRA, representing a repayment of the $36,000 distributed to them in the Coronavirus-related distribution in 2020. The participant will be able to recoup the taxes paid on their 2020 and 2021 returns and will not need to claim the final one-third of the distribution as income in 2022.

Assume a participant has a vested account balance of $75,000, is a qualified individual, and the plan sponsor has elected to allow for increased plan loans. The participant borrows the $75,000 and elects not to begin making loan payments until 1/1/2021. The $75,000 loan will have to be repaid in 60 months in order to avoid a taxable event. What if the participant cannot afford the loan payments on the $60,000 loan? The loan will be defaulted and income tax will be due on the unpaid loan balance and the participant will incur a 10% excise tax penalty if they are younger than age 59 ½ .

As these examples illustrate a substantial amount of thought needs to be taken into consideration before a participant utilizes their retirement plan assets for their financial needs.

By Jeff Atwell, AIF, C(k)P, CPFA , Principal, TRG Fiduciary Services, LLC