Resources

-

Unintended Effects on Plan Contributions

- September 28, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

No Comments

The second key element in “Defining a Retirement Plan Standard of Excellence” is Inspiring participants to save for retirement. There are several methods through which this can be accomplished: automatic enrollment, auto escalation, financial wellness programs, investment advice, and managed accounts. It’s a great time of year to begin discussions about these concepts with plan sponsors.

-

Insight for Designing a Qualified Retirement Plan for a Standard of Excellence

- September 3, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The second element of our Standard of Excellence is to inspire participants to save for retirement. We’re looking at a white paper that highlights this element, and how the Secure Act makes creates a significant opportunity for qualified plan professionals to provide participants with the resources and knowledge to reach their retirement income goal.

-

Roadblocks to Retirement Plan Success

- July 20, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Retirement plan professionals and retirement plan sponsors should focus on implementing processes and procedures to assist the participants covered by the qualified retirement in saving for a dignified retirement. This includes being aware of these five potential barriers to successful retirement outcomes.

-

Plan Design Matters

- June 29, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

As plan sponsors begin to evaluate their plans and the impact that the COVID pandemic has had on their retirement plan, the importance of plan design becomes clear. As the country emerges from the COVID pandemic, the time could not be better to prove the private retirement system provides a much better resource for participants to reach their retirement goals. Discussing with plan sponsors and implementing the 3 topics discussed in the DCIIA article will go a long way towards proving the private retirement system is better than any state or federally run private sector retirement plan.

-

Are State Sponsored Retirement Plans the Answer?

- June 9, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Over 28 states are in the process of developing a state sponsored plan and 12 states have implemented a state sponsored plan. While there has been a debate on the subject for several years, private sector retirements continue to be the best resource for private sector employers to provide retirement benefits for their employees.

-

SECURE Act Increases Access to Retirement Plans with “Pooled Employer Plans”

- May 22, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

PEPs, or Pooled Employer Plans, will provide a very efficient way for a business owner to provide retirement benefits for employees; however, the plan must always remain in the best interest of the participants and beneficiaries covered by the plan. We’re looking at the provisions of the SECURE Act that dictate how PEPs can be used, and factors that need to be considered.

-

DC Plan Sponsors React to Coronavirus with Moderation

- April 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Retirement plan professionals and plan sponsors are continuing to evaluate the provisions of the CARES Act. The majority of plans have now elected to adopt some or all of the CARES Act provisions. This creates an opportunity for retirement plan professionals to create added value for plan sponsors and participants who are, or might be considering utilizing the CARES Act options.

-

Plan Professionals Provide Value Amid COVID-19 Impacts

- April 16, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The true impact on retirement plans created by Covid-19 and the CARES Act will not be determined for awhile. This is a great opportunity for retirement plan professionals to assist their plan sponsors and participants in managing the options created by the CARES Act and developing effective communication with plan participants to assist them in managing their retirement assets prudently. We offer a brief list of services that professional, qualified plan service providers can offer to plan sponsors to assist them and their participants in staying on track meeting their retirement goals.

-

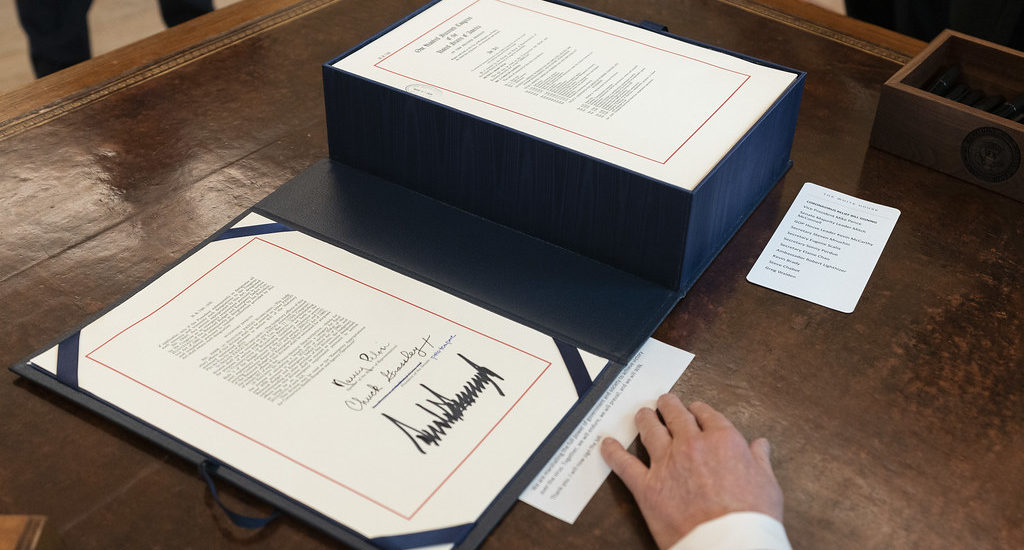

The Coronavirus, Aid, Relief and Economic Security (CARES) Act

- March 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The Coronavirus, Aid, Relief and Economic Security (CARES) Act contains provisions to allow Plan Sponsors to amend their qualified retirement plan to create additional financial resources for their employees.

-

Considering Customization for your Retirement Plan

- March 17, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Current market conditions will require employers to review the investments in the company sponsored 401(k) plan, creating an opportunity for qualified plan professionals. Qualified plan professionals can assist Plan Sponsors in evaluating a more customized approach to the investments offered to plan participants.

If you have any questions or concerns we’d love to here from you. You can call us or email us by clicking on the button below.

TRG has been a key partner in the UBMD Family Medicine 401k plan for over 12 years, providing assistance with fiduciary and investment services. The TRG team has always provided us with excellent advice, guidance and customer service. Any one of them will make themselves available to you whenever needed. We are very thankful for their help and support!