participants

-

DC Plan Sponsors React to Coronavirus with Moderation

- April 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

No Comments

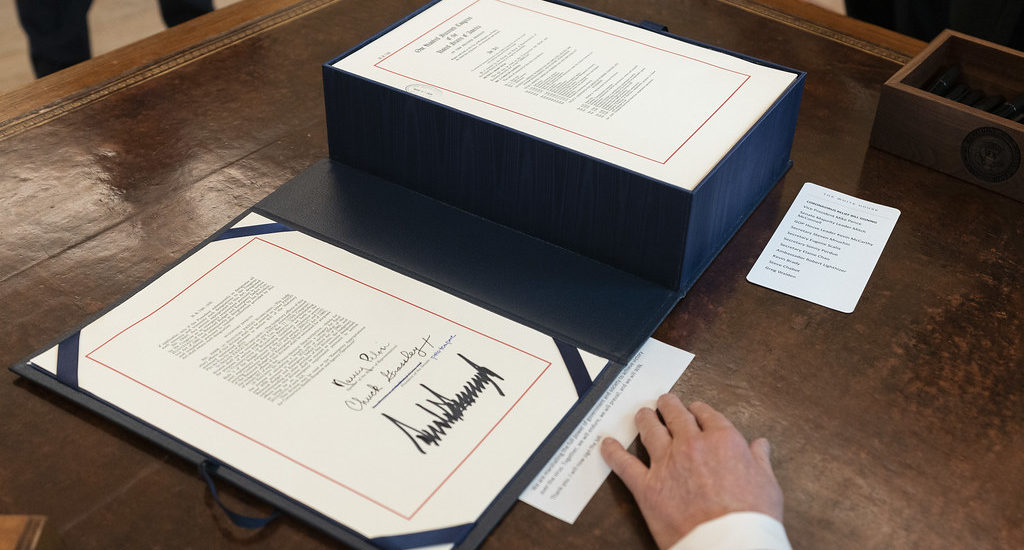

Retirement plan professionals and plan sponsors are continuing to evaluate the provisions of the CARES Act. The majority of plans have now elected to adopt some or all of the CARES Act provisions. This creates an opportunity for retirement plan professionals to create added value for plan sponsors and participants who are, or might be considering utilizing the CARES Act options.

-

Plan Professionals Provide Value Amid COVID-19 Impacts

- April 16, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The true impact on retirement plans created by Covid-19 and the CARES Act will not be determined for awhile. This is a great opportunity for retirement plan professionals to assist their plan sponsors and participants in managing the options created by the CARES Act and developing effective communication with plan participants to assist them in managing their retirement assets prudently. We offer a brief list of services that professional, qualified plan service providers can offer to plan sponsors to assist them and their participants in staying on track meeting their retirement goals.

-

Retirement and Financial Wellbeing

- February 12, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Professional service providers, working with qualified Plan Sponsors, have so many tools and resources available to assist Plan Sponsors in reaching the goals and objectives relating to workplace financial wellbeing. The end result will be a successful private retirement system inspiring participants to save for a dignified retirement.

-

Inspiring Participants and Perceptions of Risk

- December 16, 2019

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

A key element in Defining a Retirement Plan Standard of Excellence is inspiring participants to save for retirement. Most participants do not have the time, knowledge, or inclination to make good investment decisions and emotions play an important role in the participant’s investment decisions. At some point there will be a test of the quality of the QDIA being utilized in the Plan. It is imperative Plan Fiduciaries devote time to properly evaluate the Plan’s QDIA or engage an expert to assist them in doing so.

If you have any questions or concerns we’d love to here from you. You can call us or email us by clicking on the button below.

TRG has supported the Hanes Supply Inc. 401K plan for the last seven years. The service provided by TRG is world class. When it comes to the administration, recordkeeping for the plan and their year-end compliance, TRG’s annual plan audit always run smoothly. They are always there to answer any question that an associate may have and their web site is very informative and easy to use. Hanes Supply looks forward to working with TRG in the future.