plan sponsors

-

Design of Financial Wellness Programs: What Do Employees Want and Whom Do They Trust?

- July 25, 2022

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

No Comments

Financial Wellness programs have always been a consideration of employers sponsoring a 401(k) plan, but the value added compared to the investment in time and resources has created a barrier for plan sponsors. However, according to new statistics, it is more important than ever for plan sponsors to consider implementing a financial wellness program.

-

Planning for Retirement Income Needs

- March 14, 2022

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

There has never been a greater opportunity for qualified plan professionals to assist retirement plan participants in planning for their retirement income needs. Targeted and effective plans and financial education are valuable tools when considering how plans can be designed to help retirees achieve the goal of securing their retirement.

-

Key Considerations for Plan Sponsors

- January 18, 2022

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Plan Sponsors should consider the role that employers play, how employers can assist those nearing retirement, and what resources participants have available to them. Working with Advisors to creating ongoing education and communication programs is key to ensuring participants’ success in retirement.

-

New and Ongoing Priorities Among Plan Sponsors

- August 8, 2021

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

The White Paper we discuss shows that the plan sponsor need for assistance has never been greater. Qualified plan professionals can assist plan sponsors in meeting all these needs.

-

DC Plan Sponsors React to Coronavirus with Moderation

- April 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Retirement plan professionals and plan sponsors are continuing to evaluate the provisions of the CARES Act. The majority of plans have now elected to adopt some or all of the CARES Act provisions. This creates an opportunity for retirement plan professionals to create added value for plan sponsors and participants who are, or might be considering utilizing the CARES Act options.

-

Plan Professionals Provide Value Amid COVID-19 Impacts

- April 16, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The true impact on retirement plans created by Covid-19 and the CARES Act will not be determined for awhile. This is a great opportunity for retirement plan professionals to assist their plan sponsors and participants in managing the options created by the CARES Act and developing effective communication with plan participants to assist them in managing their retirement assets prudently. We offer a brief list of services that professional, qualified plan service providers can offer to plan sponsors to assist them and their participants in staying on track meeting their retirement goals.

-

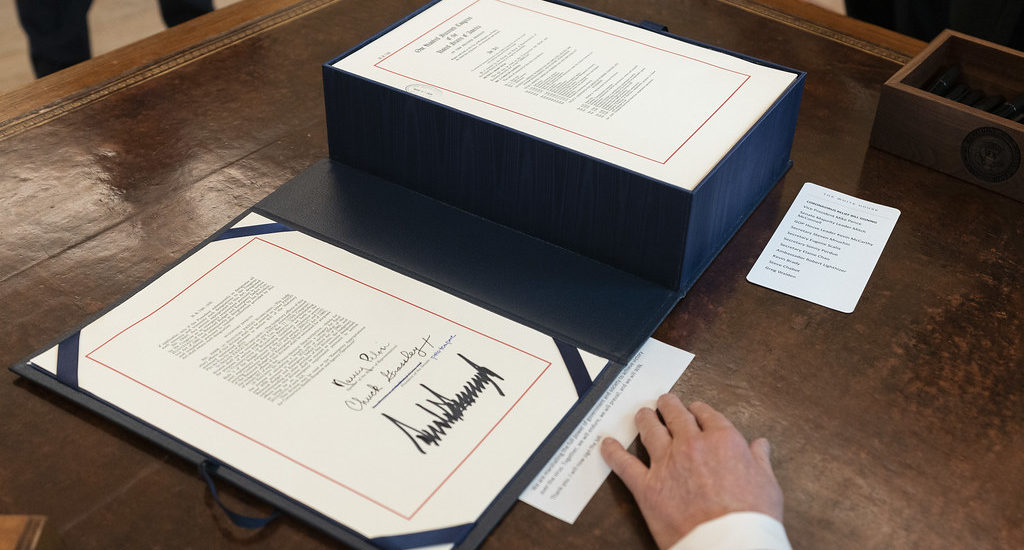

The Coronavirus, Aid, Relief and Economic Security (CARES) Act

- March 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The Coronavirus, Aid, Relief and Economic Security (CARES) Act contains provisions to allow Plan Sponsors to amend their qualified retirement plan to create additional financial resources for their employees.

-

Considering Customization for your Retirement Plan

- March 17, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Current market conditions will require employers to review the investments in the company sponsored 401(k) plan, creating an opportunity for qualified plan professionals. Qualified plan professionals can assist Plan Sponsors in evaluating a more customized approach to the investments offered to plan participants.

-

Plan Leakage and the Impact of Withdrawing Savings Before Retirement

- February 24, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Leakage has been a big issue for many years, causing many individuals to accumulate less in retirement assets than they otherwise would have. This provides a tremendous opportunity for retirement plan professionals to work with plan sponsors to implement procedures or plan features which will help preserve a participant’s retirement account.

-

Target Fund Dates: Surprising Facts

- January 29, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

In 2006 the Pension Protection Act added Qualified Default Investment Alternative regulations, QDIA, to ERISA. One of the 3 QDIA alternatives a Plan Fiduciary could choose as a safe harbor investment is a Target Date Fund. As a result, the amount of 401(k) assets being deposited into Target Date Funds has increased substantially over the years.

- 1

- 2

If you have any questions or concerns we’d love to here from you. You can call us or email us by clicking on the button below.

TRG has been a key partner in the UBMD Family Medicine 401k plan for over 12 years, providing assistance with fiduciary and investment services. The TRG team has always provided us with excellent advice, guidance and customer service. Any one of them will make themselves available to you whenever needed. We are very thankful for their help and support!