retirement

-

Insight for Designing a Qualified Retirement Plan for a Standard of Excellence

- September 3, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

No Comments

The second element of our Standard of Excellence is to inspire participants to save for retirement. We’re looking at a white paper that highlights this element, and how the Secure Act makes creates a significant opportunity for qualified plan professionals to provide participants with the resources and knowledge to reach their retirement income goal.

-

Roadblocks to Retirement Plan Success

- July 20, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Retirement plan professionals and retirement plan sponsors should focus on implementing processes and procedures to assist the participants covered by the qualified retirement in saving for a dignified retirement. This includes being aware of these five potential barriers to successful retirement outcomes.

-

DC Plan Sponsors React to Coronavirus with Moderation

- April 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

Retirement plan professionals and plan sponsors are continuing to evaluate the provisions of the CARES Act. The majority of plans have now elected to adopt some or all of the CARES Act provisions. This creates an opportunity for retirement plan professionals to create added value for plan sponsors and participants who are, or might be considering utilizing the CARES Act options.

-

Plan Professionals Provide Value Amid COVID-19 Impacts

- April 16, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The true impact on retirement plans created by Covid-19 and the CARES Act will not be determined for awhile. This is a great opportunity for retirement plan professionals to assist their plan sponsors and participants in managing the options created by the CARES Act and developing effective communication with plan participants to assist them in managing their retirement assets prudently. We offer a brief list of services that professional, qualified plan service providers can offer to plan sponsors to assist them and their participants in staying on track meeting their retirement goals.

-

The Coronavirus, Aid, Relief and Economic Security (CARES) Act

- March 30, 2020

- Posted by: Jeff Atwell

- Category: Economics, Financial Plan, Resources

The Coronavirus, Aid, Relief and Economic Security (CARES) Act contains provisions to allow Plan Sponsors to amend their qualified retirement plan to create additional financial resources for their employees.

-

Considering Customization for your Retirement Plan

- March 17, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Current market conditions will require employers to review the investments in the company sponsored 401(k) plan, creating an opportunity for qualified plan professionals. Qualified plan professionals can assist Plan Sponsors in evaluating a more customized approach to the investments offered to plan participants.

-

Retirement and Financial Wellbeing

- February 12, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Professional service providers, working with qualified Plan Sponsors, have so many tools and resources available to assist Plan Sponsors in reaching the goals and objectives relating to workplace financial wellbeing. The end result will be a successful private retirement system inspiring participants to save for a dignified retirement.

-

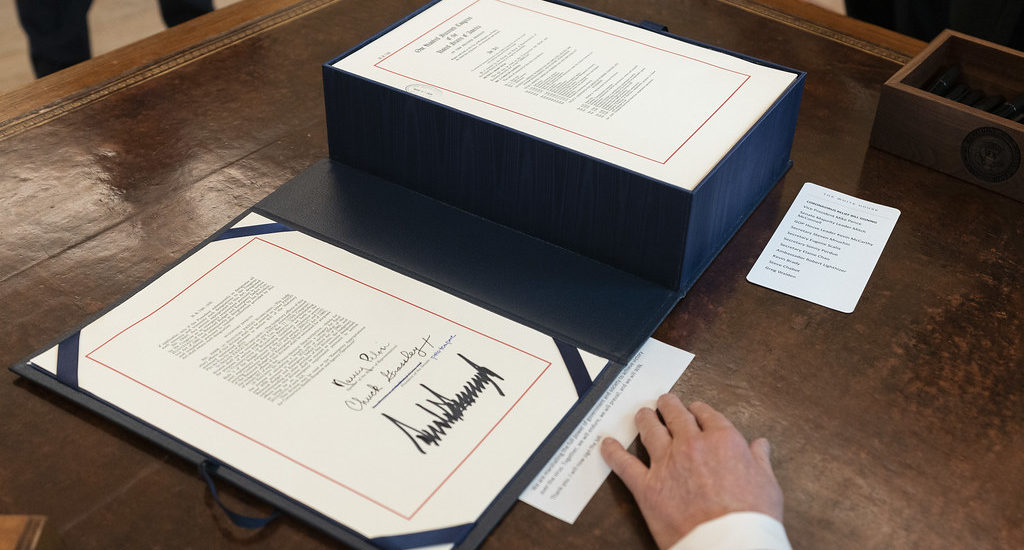

The SECURE Act is signed into law

- January 5, 2020

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

Congress recently passed and President Trump signed into law the SECURE Act, a great opportunity for retirement plan professionals going into 2020. Learn how changes will affect your plan or how your plan can be enhanced, and increase participant education with new requirements.

-

Inspiring Participants and Perceptions of Risk

- December 16, 2019

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

A key element in Defining a Retirement Plan Standard of Excellence is inspiring participants to save for retirement. Most participants do not have the time, knowledge, or inclination to make good investment decisions and emotions play an important role in the participant’s investment decisions. At some point there will be a test of the quality of the QDIA being utilized in the Plan. It is imperative Plan Fiduciaries devote time to properly evaluate the Plan’s QDIA or engage an expert to assist them in doing so.

-

Loan Leakage: Preventing Loan Defaults from Draining America’s 401(k) Accounts

- November 21, 2019

- Posted by: Jeff Atwell

- Category: Financial Plan, Resources

We’re continuing our discussion on loan leakage and looking at America’s $2 trillion retirement loan dilemma. Our resource explores different mechanisms to prevent loan leakage, illustrates the impact on individuals, and addresses the increased fiduciary risk associated with loan leakage.

If you have any questions or concerns we’d love to here from you. You can call us or email us by clicking on the button below.

TRG has been a key partner in the UBMD Family Medicine 401k plan for over 12 years, providing assistance with fiduciary and investment services. The TRG team has always provided us with excellent advice, guidance and customer service. Any one of them will make themselves available to you whenever needed. We are very thankful for their help and support!